san antonio general sales tax rate

Historical Sales Tax Rates for San Antonio. You can print a 7 sales tax table here.

How To Calculate Taxes And Discounts Basic Concept Formulas And Examples Cuemath

Maintenance Operations MO and Debt Service.

. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. The tax rate varies from year to year depending on the countys needs.

Did South Dakota v. The Florida sales tax rate is currently 6. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

For tax rates in other cities see Florida sales taxes by city and county. This includes the rates on the state county city and special levels. View the printable version of city rates PDF.

San Antonio TX Sales Tax Rate. Within San Antonio there are around 82 zip codes with the most populous zip code being 78245. The current total local sales tax rate in San Antonio NM is 63750.

There is no applicable city tax or special tax. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. The Texas Comptroller states that payment of motor vehicle sales.

You can find these fees further down on. The December 2020 total local sales tax rate was also 63750. 1000 City of San Antonio.

Texas Sales Tax Table at 625 - Prices from 100 to 4780 Print This Table Next Table starting at 4780 Price Tax. The minimum combined 2021 sales tax rate for san antonio texas is. The County sales tax rate is 1.

The property tax rate for the City of San Antonio consists of two components. Texas Comptroller of Public Accounts. San Antonios current sales tax rate is 8250 and is distributed as follows.

San Antonio TX 78207. 100 Dolorosa San Antonio TX 78205 Phone. San Antonio collects the maximum legal local sales tax.

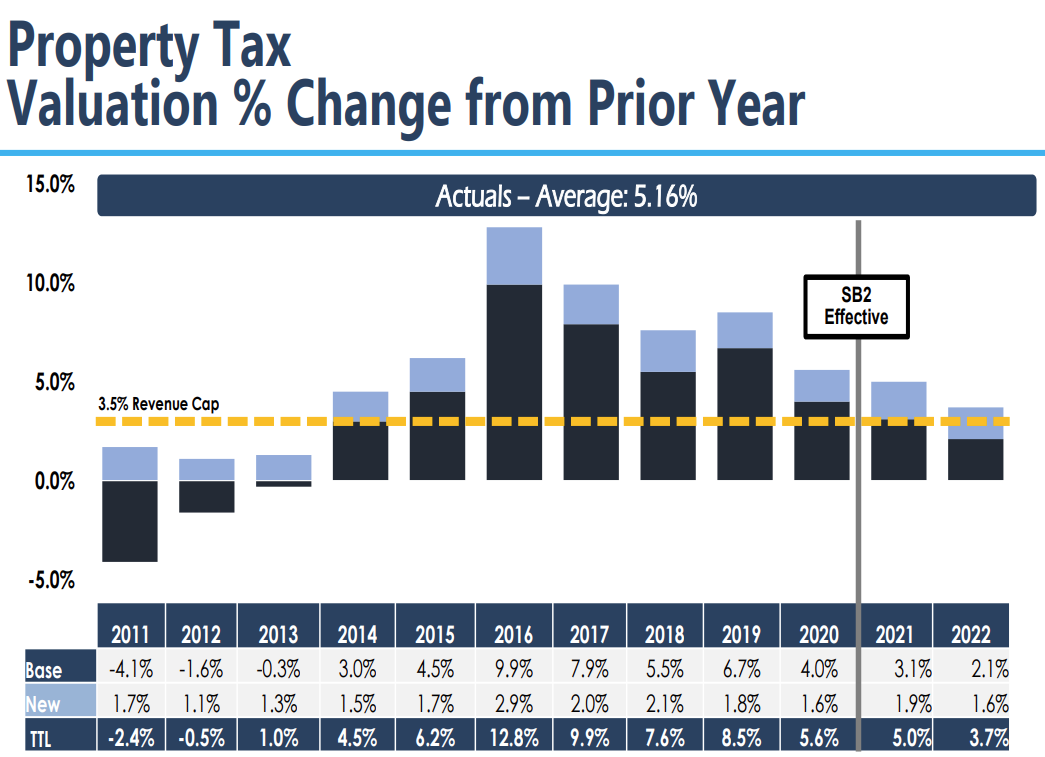

You can find more tax rates and allowances for. The law caps property taxes at 35 unless voters approve an increase or a disaster triggers a rate increase to 8. The December 2020 total local sales tax rate was also 7000.

Bexar Co Es Dis No 12. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. Waco TX Sales Tax Rate.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. The current total local sales tax rate in San Antonio FL is 7000. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax.

San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250. 2020 rates included for use while preparing your income tax deduction. The Bexar County sales tax rate is 0 however the San Antonio MTA and ATD sales tax rates are 05 and 025 respectively meaning that the minimum sales tax you will have to pay in Bexar County and specifically San Antonio when combined with the base rate of sales and use tax in Texas is 825.

0125 dedicated to the City of San Antonio Ready to Work Program. San Antonio has parts of it located within Bexar County and Comal County. The average cumulative sales tax rate in San Antonio Texas is 822.

This is the total of state county and city sales tax rates. City sales and use tax codes and rates. The December 2020 total local sales tax rate was also 8250.

Sales and use tax san antonios current sales tax rate is 8250 and is distributed as follows. Sales and Use Tax. 2020 Tax Rate Calculation Worksheet Form 50-856.

San Antonios current sales tax rate is 8250 and is distributed as follows. Wichita Falls TX Sales Tax Rate. Abilene TX Sales Tax Rate.

The December 2018 total local sales tax rate was also 8250. The County sales tax rate is 1. Object moved to here.

The San Antonio Texas general sales tax rate is 625. The latest sales tax rates for cities in Texas TX state. The minimum combined 2022 sales tax rate for San Antonio Florida is 7.

The arkansas sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. San Antonio Sales Tax Rates for 2022. City Sales and Use Tax.

Rates include state county and city taxes. The San Antonio sales tax rate is 0. 0125 dedicated to.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. Every 2018 combined rates mentioned above are the results of texas state rate 625 the county rate 0 to 05. The San Antonio Mta Sales Tax is collected by the merchant on all qualifying sales made within San Antonio Mta.

The San Antonio Texas general sales tax rate is 625. The average sales tax rate in arkansas is 8551. Download city rates XLSX.

The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. There is no applicable county tax. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected.

While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. The state sales tax rate in Texas is 625 but you can customize this table as needed to reflect your applicable local sales tax rate. The current total local sales tax rate in San Antonio TX is 8250.

The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special district sales tax used to fund transportation districts local attractions etc.

Understanding California S Sales Tax

What Transactions Are Subject To The Sales Tax In Texas

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Understanding California S Sales Tax

Worksheet For Completing The Sales And Use Tax Return Form 01 117

Sales Tax Rates In Major Cities Tax Data Tax Foundation

My Specialization Is In Irs And Illinois Department Of Revenue Tax Problems I Represent Many Individuals And Businesses With Sale Tax Lawyer Business Tax Irs

Understanding California S Sales Tax

Understanding California S Sales Tax

Texas Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Understanding California S Sales Tax

Effective Tax Rates How Much You Really Pay In Taxes

Texas Sales Tax Guide For Businesses

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Which Cities And States Have The Highest Sales Tax Rates Taxjar